- FORUM

- PROJECTS

- ABOUT US

- RESOURCES

- CONTACT US

- FORUM

- PROJECTS

- ABOUT US

- RESOURCES

- CONTACT US

Investment and Funding of Urban Redevelopment Schemes

Urban redevelopment or renewal involves improvement of the physical environment and its quality. A proper evaluation of urban re- development cannot, therefore, be undertaken without also considering the overall fiscal impact of the various programmes on the community. Since the size of such redevelopment must be limited under Indian conditions be- cause of budgetary restraints on subsidized ventures – apart from the initial outlay needed to pay compensation for acquiring high-cost land in congested localities – it is to be considered whether a better course of action would not be to limit public expenditure for improving the environmental facilities of the blighted areas, rather than trying to clear these.

Financing Tools of urban redevelopment are

Value Capture Financing (VCF) is a type of public financing that acts as a tax collection mechanism and aims to recover part or full of the value that public infrastructure generates for private landowners. It owes to act as a funding source for urban investment

Appropriate VCF tools can be deployed to capture a part of the increment in value of land and buildings. In turn. these can be used to fund projects being set up for the public by the Central/ State Governments and ULBs. This generates a virtuous cycle in which value is created. realized and captured. and used again for project investment.

Value Capture Methods and scale of intervention 22

| S.No | Value capture method | Frequency of incidence | Scale of intervention |

| 1 | Land value tax | Annual rates based on gain inland value uniformly | Area-based |

| 2 | Fees for changing land use (agricultural to non-agricultural) | One-time at the time of giving permission for change of land use | Area/ Project -based |

| 3 | Betterment levy | One-time while applying for project development Rights | Area/ Project-based |

| 4 | Development charges (Impact Fees) | One-time | Area-based |

| 5 | Transfer of Development Rights | Transaction-based | Area/project-based |

| 6 | Premium on relaxation of rules or additional FSI | One-time | Area (Roads, railways) / Project (Metro) |

| S.No | Value capture method | Frequency of incidence | Scale of intervention |

| 7 | Vacant land tax | Recurring | Area-based |

| 8 | Tax increment financing | Recurring and for a fixed period | Area-based |

| 9 | Land Acquisition and Development | One-time upfront before project initiation | Area/ Project-based |

| 10 | Land pooling System | One-time upfront before project initiation | Area/ Project-based |

Various methods of Value Capture have been used by the Rajasthan state :

Urban Land Tax Section 20 Notification -Government of Rajasthan. Local Self Government.

Urban Development & Housing Department

Tax on Conversion of Land Section 90-A of Rajasthan Land Revenue Act, 1956

Development Charge/Impact fees Section 106 Rajasthan Municipalities Act.2009

TDR and Incentive FSI : Policy of TDR –Rajasthan- 2012

Premium on relaxation of rules or additional FSI : RTIDF betterment levy on premium FAR along the two metro corridor for height upto FAR of 4 rather then 1.33

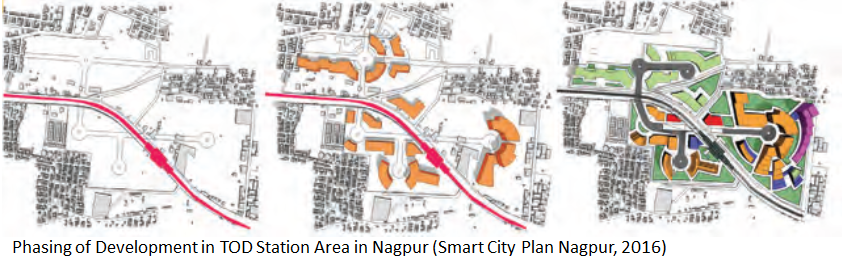

Nagpur proposes to plan and develop intense TOD zones around metro stations in the ABD by land pooling and readjustment, alternatively called as Town Planning Schemes (TPS). The Smart City Plan proposes to use TPS in the site under the following arrangement- 23

• For un-built plots, the authority will appropriate 40% and return 60% of the land to the owner

• In the rare case where a built property is impacted, the owner shall be compensated in any of the following manners-

• land at an alternate location within the TPS area

• Increased FAR

• Transfer of Development Rights

Register & Download PDF for Educational Purposes Only

Urban Development Management Study notes for M. plan Sem-III

Urban Development Management.pdf

Register as member and login to download attachment [pdf] by right-click the pdf link and Select “Save link as” use for Educational Purposes Only

Disclaimer

Information on this site is purely for education purpose. The materials used and displayed on the Sites, including text, photographs, graphics, illustrations and artwork, video, music and sound, and names, logos, IS Codes, are copyrighted items of respective owners. Front Desk is not responsible and liable for information shared above.