- FORUM

- PROJECTS

- ABOUT US

- RESOURCES

- CONTACT US

- FORUM

- PROJECTS

- ABOUT US

- RESOURCES

- CONTACT US

A Project Financing Need Assessment is a process of evaluating the funding requirements for a specific project, including the estimated cost of the project and the available sources of financing. This assessment helps to determine the amount and type of financing needed to successfully complete the project, and identifies any potential gaps between the expected costs and the available funding. It may involve an analysis of the project’s revenue and cash flow projections, an assessment of the creditworthiness of the project and the sponsors, and a consideration of alternative financing options. The ultimate goal of a Project Financing Need Assessment is to ensure that the project has the necessary financial resources to meet its goals and achieve success.

The project financing need assessment of an urban infrastructure project involves evaluating the following key factors:

Project scope and size: The estimated cost of the infrastructure project, including labor, materials, and other expenses, must be accurately determined to assess the financing needs.

Revenue streams: Revenues generated by the project, such as tolls, fees, and taxes, must be estimated to determine the project’s ability to repay debt and cover ongoing costs.

Project timeline: A realistic timeline must be established to ensure that the project is completed on time and within budget, which affects the amount of financing required.

Market demand: The demand for the infrastructure project must be evaluated to determine its economic viability and ability to generate sufficient revenue to repay debt and cover ongoing costs.

Risk assessment: A risk assessment must be performed to identify potential threats to the project’s financial viability, such as changes in regulations, unexpected costs, or delays in construction.

Based on this evaluation, a decision can be made regarding the type and amount of financing required to successfully complete the urban infrastructure project.

Project finance

Project finance refers to the long term financing of infrastructure and industrial projects based on the projected cash flows of the project rather than the balance sheets of the project sponsors

Project finance is a financing approach that provides funding for a specific project based on its projected cash flows. The funding is typically provided by a consortium of lenders, and the repayment of the debt is solely dependent on the success of the project. Project finance allows the sponsors of the project to separate the risk associated with the project from their own balance sheets, which can help to reduce the overall risk to the project sponsors. Additionally, project finance can provide an attractive financing option for large-scale, complex infrastructure and industrial projects as it provides a way to secure long-term funding for these types of projects.

Project finance is a type of financing that is structured around the revenue-generating potential of a specific project, rather than the creditworthiness of the project sponsor. In project finance, lenders consider the future cash flows generated by the project to determine the viability of the project and the ability to repay the loan. This approach allows sponsors to finance large-scale infrastructure or industrial projects without putting their own balance sheets at risk. Project finance is typically used for long-term investments and is commonly used in sectors such as energy, transportation, and real estate development.

FD Planning Community Forum Discussion

- Community Participation Process in planning

- Appreciation of decision-making processes

- Process in relation to varied consultancy assignments of planning

- Project Financing Need Assessment

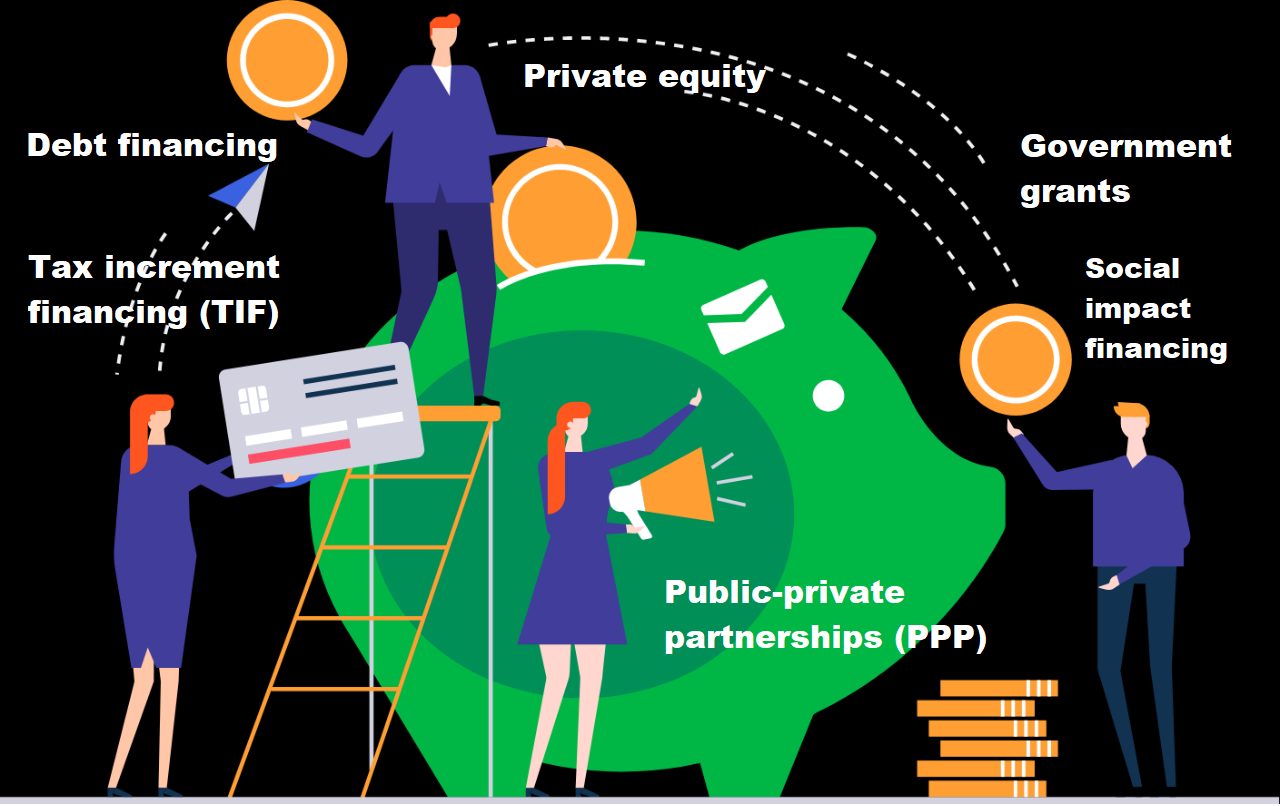

- Projects Financing : Sources of funds

- The disposition of funds in urban development projects

- Planning for project Financing

- Project Monitoring and Criteria for decision making

- Project monitoring : Parameters and Tools of Control

- Use of Network Analysis in Project Monitoring

- Reporting and Corrective Actions

- Resource management and project reporting

- Project Evaluation- Methods, tools, time frame and results

- Project Cash Flows

- Principles of Cash Flow Estimation

- Project Benefits

- Financial closure of project

- Presentation of evaluation findings

Disclaimer

Information on this site is purely for education purpose. The materials used and displayed on the Sites, including text, photographs, graphics, illustrations and artwork, video, music and sound, and names, logos, IS Codes, are copyrighted items of respective owners. Front Desk is not responsible and liable for information shared above.