- FORUM

- PROJECTS

- ABOUT US

- RESOURCES

- CONTACT US

- FORUM

- PROJECTS

- ABOUT US

- RESOURCES

- CONTACT US

The Municipal Finance Assessment Framework (MFAF) is a tool developed by the World Bank to help local governments and municipalities assess their financial performance and identify areas for improvement. The framework is designed to be adaptable to the specific needs and circumstances of each municipality.

The MFAF consists of three main components:

- Financial sustainability assessment: This component assesses the municipality’s financial performance and sustainability by analyzing revenue sources, expenditure patterns, debt levels, and financial management practices. The assessment provides insights into the municipality’s ability to generate revenue, manage expenditure, and maintain long-term financial stability.

- Service delivery assessment: This component assesses the municipality’s capacity to deliver services to its residents, such as water supply, sanitation, and solid waste management. The assessment looks at factors such as infrastructure, human resources, and institutional capacity to identify strengths and weaknesses in service delivery.

- Institutional assessment: This component assesses the municipality’s governance and institutional arrangements, including its legal and regulatory framework, decision-making processes, and accountability mechanisms. The assessment helps identify areas where the municipality’s institutional capacity can be strengthened to support financial sustainability and effective service delivery.

The MFAF is designed to be a participatory process, involving key stakeholders such as local government officials, residents, and civil society organizations. It provides a comprehensive and integrated approach to assessing municipal finance, service delivery, and governance, and can help identify priority areas for reform and investment.

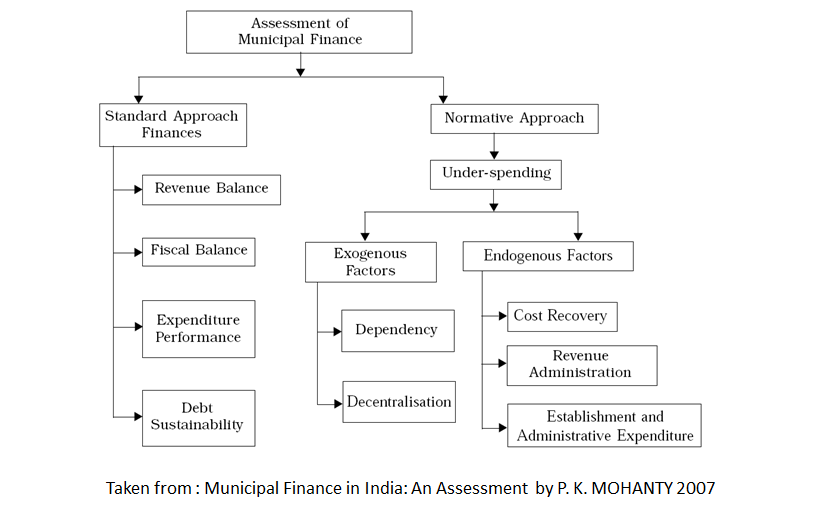

“Standard Approach” for making financial assessment may not hold for the ULBs

the assessment of ULBs are based on alternate parameters of normative benchmarks which define the minimum level of expenditure that the ULBs are required to incur, in order to ensure a minimum standard of living to the inhabitants.

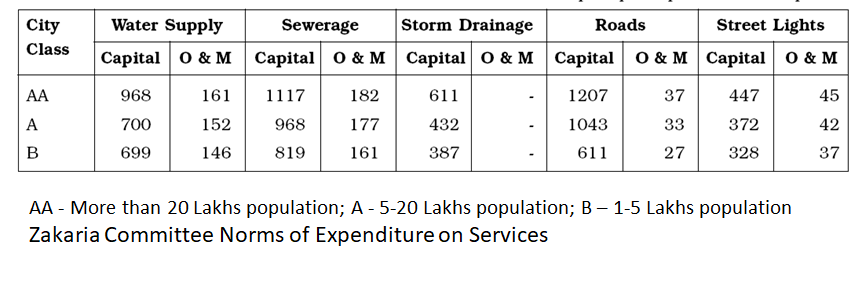

A set of expenditure benchmarks, both for creating new assets, and for their maintenance were derived by the Zakaria Committee in 1964 for core urban services. These expenditure norms for service provision (capital) as well as operation & maintenance (O&M) are for the cities that are divided into categories AA, A, B, C, D and E, based on the population size.

The expenditure norms for 5 core civic activities viz., water supply, roads, storm water drainage, sewerage and street lighting for 3 major city classes covered by this study (at the 1996-97 prices) are shown in Table 9

A comparison of municipal spending with these norms, after revising them to the current period, would reveal the level of under-spending by the ULBs. There are a host of factors which could be responsible for the level of under-spending, which can be divided into two broad categories. –

exogenous : are those that are not within the control of concerned ULB

endogenous. : refer to those that have to do with the ULBs’ own operations.

Exogenous factors include: •delegation of revenue powers (decentralization) Revenue decentralization ratio is measured by ratio of MC’s per capita revenue to State per capita revenue receipt. •dependency of ULB for resources on upper tier of government (dependency ratio). refers to the share of grants a MC receives to its total expenditure.

Endogenous factors include:

•revenue (tax) administration, The ratio of per capita own revenue of MC to State GDP (GSDP) per capita could be taken as a close approximation of the efficiency of revenue administration

•cost recovery : ratio of municipal fees and user charges to revenue expenditure incurred by an MC for the provision of respective services viz., water supply, sanitation, health services, education and street lighting.

•quality of expenditure.

By using the MFAF, municipalities can improve their financial performance and sustainability, enhance service delivery, and strengthen institutional capacity. The framework can also help local governments attract investment and support from development partners by demonstrating their commitment to good governance and financial management

Download Study Notes PDF

Register as member and login to download attachment use this only for Educational Purpose

FD Planning Community Forum Discussion

- State Finance Commissions and Rural Local Bodies Devolution of Resources

- Interview with B K Sinha – The Municipal midas

- Municipal bond in India

- Bilateral and Multi-lateral Financial Institutions

- Cost recovery

- Investment needs and Budgeting for Infrastructure and Service in Metro towns

- Subsidy Reduction

- Revenue Sources of Controlling Authorities

- Public Private partnership

Disclaimer

Information on this site is purely for education purpose. The materials used and displayed on the Sites, including text, photographs, graphics, illustrations and artwork, video, music and sound, and names, logos, IS Codes, are copyrighted items of respective owners. Front Desk is not responsible and liable for information shared above.

[…] Municipal Finance Assessment Framework […]

3 Comments

[…] Municipal Finance Assessment Framework […]

[…] Municipal Finance Assessment Framework […]