Endogenous. : factors refer to those that have to do with the ULBs’ own operations which could be responsible for the level of under-spending

Endogenous factors refer to the internal factors that impact the financial performance of a municipality. These factors can be influenced and controlled by the local government itself. The following are some of the endogenous factors that can impact municipal finance:

- Revenue sources: The revenue sources available to a municipality play a critical role in its financial performance. Municipalities that have a diversified revenue base, including taxes, fees, and grants, are likely to have a more stable financial position than those that rely on a single source of revenue.

- Expenditure patterns: The way a municipality spends its resources also affects its financial performance. Municipalities that prioritize capital investment and maintenance of infrastructure tend to have better financial sustainability than those that prioritize operational expenditures.

- Debt management: Municipal debt is a significant factor that can impact the financial sustainability of a municipality. Municipalities that have a well-managed debt portfolio and a clear debt repayment plan are likely to be viewed more favorably by investors and creditors.

- Service delivery: The quality and efficiency of service delivery can also impact municipal finance. Municipalities that are able to deliver high-quality services at a lower cost are likely to be more financially sustainable than those that struggle with service delivery.

- Governance and institutional capacity: The institutional capacity of a municipality, including its governance structures and decision-making processes, can also impact its financial performance. Municipalities that have strong governance structures, transparent decision-making processes, and effective accountability mechanisms are likely to be more financially sustainable than those that lack these qualities.

Revenue (tax) administration, The ratio of per capita own revenue of MC to State GDP (GSDP) per capita could be taken as a close approximation of the efficiency of revenue administration

Ranking based on Efficiency of Revenue Administration and Under-spending of the Municipal Corporations (Average of 1999-00 to 2003-04)

cost recovery : ratio of municipal fees and user charges to revenue expenditure incurred by an MC for the provision of respective services viz., water supply, sanitation, health services, education and street lighting

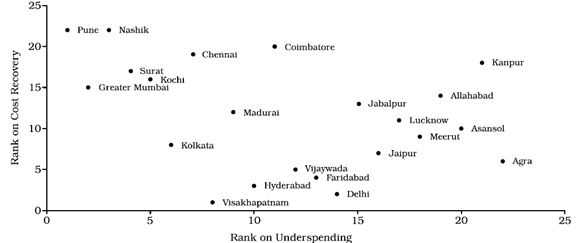

Ranking based on Cost recovery ratio and Under-spending of the Municipal Corporations (Average of 1999-00 to 2003-04)

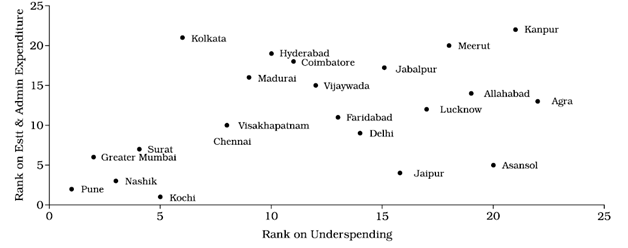

Ranking based on Average Establishment and Administration Expenditure of the Municipal Corporations (Average of 1999-00 to 2003-04)

Taken from : Municipal Finance in India: An Assessment by P. K. MOHANTY 2007

Municipal Finance Assessment Framework

Download Study Notes PDF

Register as member and login to download attachment use this only for Educational Purpose

FD Planning Community Forum Discussion

- State Finance Commissions and Rural Local Bodies Devolution of Resources

- Interview with B K Sinha – The Municipal midas

- Municipal bond in India

- Bilateral and Multi-lateral Financial Institutions

- Cost recovery

- Investment needs and Budgeting for Infrastructure and Service in Metro towns

- Subsidy Reduction

- Revenue Sources of Controlling Authorities

- Public Private partnership

Disclaimer

Information on this site is purely for education purpose. The materials used and displayed on the Sites, including text, photographs, graphics, illustrations and artwork, video, music and sound, and names, logos, IS Codes, are copyrighted items of respective owners. Front Desk is not responsible and liable for information shared above.

1 thought on “Municipal Finance Assessment : Endogenous factors”