Exogenous : Exogenous Factors which could be responsible for the level of under-spending in ULB these factors are not within the control of concerned ULB

Municipal finance assessment considers various exogenous factors that influence the financial health and performance of urban local bodies. These factors include:

- Economic environment: The economic environment of a city, such as its growth rate, inflation, and business environment, affects the revenue potential and expenditure needs of urban local bodies. For instance, a city with a strong economic base and higher business activity may generate more revenue through taxes and fees.

- Demographic factors: The demographic factors of a city, such as population size, age structure, and income levels, determine the demand for public services and infrastructure. For instance, a city with a higher population size and income levels may require more investment in basic services such as water, sanitation, and healthcare.

- Natural resources: The availability of natural resources such as water, land, and minerals influences the revenue potential and expenditure needs of urban local bodies. For instance, a city with adequate water resources may have a lower expenditure on water supply compared to a city with scarce water resources.

- Governance and institutional factors: The governance and institutional factors of a city, such as the level of political will, transparency, and accountability, affect the financial management practices of urban local bodies. A strong institutional framework promotes effective financial management and enhances the creditworthiness of urban local bodies.

- Legal and regulatory framework: The legal and regulatory framework governing the financial management of urban local bodies, such as the Municipal Acts, the Fiscal Responsibility and Budget Management Act, and the Goods and Services Tax Act, influence the revenue potential and expenditure needs of urban local bodies. A clear and predictable regulatory environment enhances the fiscal discipline of urban local bodies.

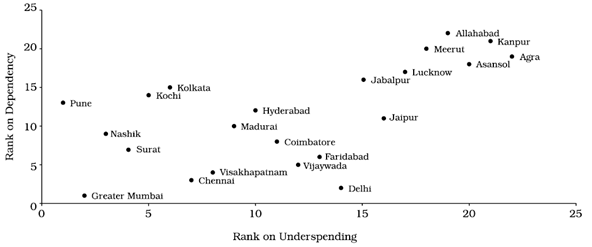

dependency of ULB for resources on upper tier of government (dependency ratio). refers to the share of grants a MC receives to its total expenditure.

Ranking based on Dependency ratio and Under-spending of the Municipal Corporations (Average of 1999-00 to 2003-04)

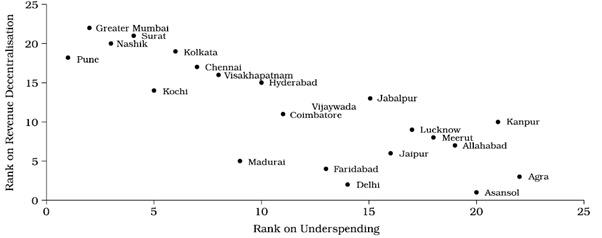

delegation of revenue powers (decentralization) Revenue decentralization ratio is measured by ratio of MC’s per capita revenue to State per capita revenue receipt.

Ranking based on Revenue decentralization ratio and Under-spending of the Municipal Corporations (Average of 1999-2000 to 2003-2004)

A comprehensive assessment of these exogenous factors along with the endogenous factors such as revenue administration, expenditure management, and debt management provides a holistic view of the financial health and performance of urban local bodies.

Municipal Finance Assessment Framework

Download Study Notes PDF

Register as member and login to download attachment use this only for Educational Purpose

FD Planning Community Forum Discussion

- State Finance Commissions and Rural Local Bodies Devolution of Resources

- Interview with B K Sinha – The Municipal midas

- Municipal bond in India

- Bilateral and Multi-lateral Financial Institutions

- Cost recovery

- Investment needs and Budgeting for Infrastructure and Service in Metro towns

- Subsidy Reduction

- Revenue Sources of Controlling Authorities

- Public Private partnership

Disclaimer

Information on this site is purely for education purpose. The materials used and displayed on the Sites, including text, photographs, graphics, illustrations and artwork, video, music and sound, and names, logos, IS Codes, are copyrighted items of respective owners. Front Desk is not responsible and liable for information shared above.

1 thought on “Municipal Finance Assessment : Exogenous factors”