The financial feasibility assessment is a critical part in the project preparation stage. It provides information about the costs, expenses and sources of revenues, and gives an indication whether the project is self-sustaining or requires additional financial support in the form of grant to make it viable. In other words, financial feasibility helps determine whether the project will make sufficient revenues to offset all the costs incurred as well as allow for a reasonable return on investment for the private partner. Financial feasibility forms the basis for determining an appropriate project structure and eventually informs the preparation of bidding documents.

The financial feasibility assessment helps to identify the potential costs and revenue streams associated with the project, and whether it is financially viable in the long term. It also helps to determine the appropriate funding sources for the project and identify any potential risks or obstacles that may affect its financial performance.

Moreover, public projects often involve public funds, and it is important to ensure that these funds are used efficiently and effectively. A financial feasibility assessment can help to identify potential cost savings and optimize the use of available resources.

The financial feasibility assessment however, is an iterative process which is done during different stages in the project – during risk analysis, determining value for proposition, assessing whether or not to proceed with a PPP structure, etc.

The financial feasibility of public projects is an important consideration for governments and public entities when making investment decisions. The following are some of the key factors that need to be considered when assessing the financial feasibility of public projects:

- Project Costs: The costs associated with the project need to be estimated accurately. These costs may include design and planning, construction, operating and maintenance expenses, financing charges, and any other relevant costs.

- Funding Sources: The sources of funding for the project need to be identified and secured. Public projects may be funded through a combination of government grants, bonds, loans, or private investment.

- Revenue Streams: Revenue streams that may be generated from the project need to be identified and estimated. Public projects may generate revenue through user fees, tolls, taxes, or other sources.

- Economic Benefits: The economic benefits of the project need to be evaluated. These benefits may include increased economic activity, job creation, and improvements in public services and infrastructure.

- Risk Analysis: The risks associated with the project need to be identified and assessed. These risks may include cost overruns, delays in completion, changes in regulatory requirements, and unforeseen events.

- Cost-Benefit Analysis: A cost-benefit analysis should be performed to evaluate the overall financial viability of the project. This analysis should consider the costs, benefits, and risks associated with the project, and should provide a clear indication of whether the project is financially feasible.

In conclusion, financial feasibility of public projects is crucial to ensure the best use of public funds and resources. A thorough analysis of project costs, funding sources, revenue streams, economic benefits, risks, and cost-benefit analysis is essential to make informed investment decisions.

Steps involved in Financial Feasibility

Formulation of Reasonable and Realistic Assumptions

Assumptions are baseline data that apply throughout and are often the drivers in a business or financial model. It is always useful to organise the assumptions into logical groups. Indicative categories of assumptions are general assumptions, financing assumptions, tax assumptions, cost and revenue assumptions and market-related assumptions.

Formulating reasonable and realistic assumptions is a critical step in financial feasibility analysis. The following are some of the steps involved in formulating assumptions for financial feasibility analysis:

- Identify key assumptions: Identify the key assumptions that will impact the financial feasibility of the project or venture. These assumptions may include projected revenues, costs, inflation rates, interest rates, and tax rates.

- Gather data: Gather data to support the assumptions. This may involve researching industry trends, market conditions, historical data, and other relevant sources of information.

- Analyze data: Analyze the data to identify trends and patterns that can inform the assumptions. This may involve using statistical analysis, financial modeling, or other analytical tools.

- Consult experts: Consult with experts in relevant fields to validate the assumptions. These experts may include economists, financial analysts, industry professionals, and other subject matter experts.

- Test assumptions: Test the assumptions by running various scenarios and sensitivity analyses. This can help to identify the potential impact of changes in key assumptions on the financial feasibility of the project or venture.

- Document assumptions: Document the assumptions and provide a clear and concise explanation of how they were derived. This documentation can serve as a reference for stakeholders and can help to ensure that the assumptions are understood and agreed upon by all parties involved.

Documenting the assumptions is also essential to ensure that stakeholders are aware of the underlying assumptions and can make informed decisions based on them.

Life Cycle Cost Analysis

Life cycle costs are measured in terms of capital expenditure and operating expenditure (O&M costs). Capital expenditure usually is calculated as the sum of the base construction cost, preliminary & pre-operative expenses, and the financing costs. Each of such component are set out below:

1. Base Construction costs: These are basic direct

costs of the project

2. Pre-operative expenses: These include accounting/ management fees, legal fees, labor burden, expenses on rent, repairs, telephone bills, travel expenditures, utilities, etc. They reflect expenditure on administration, management, risks and profits.

3. Preliminary expenses: These are costs towards carrying out engineering studies such as land surveys, concept layouts, designing, drawing and preliminary studies.

4. Financing Costs: These are costs towards financing charges collected by lenders, interest during construction (IDC) etc.

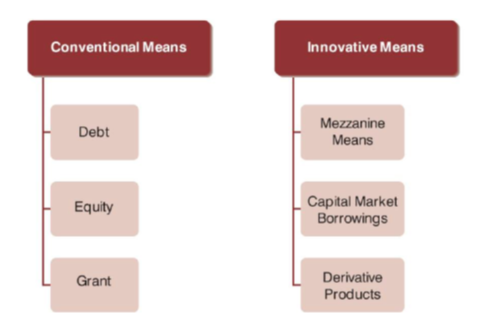

Sources of Finance

Since infrastructure projects are highly capital intensive, the private partner clearly lists out the financing risks associated with them before making an investment decision. If the project is a greenfield investment, there would be no cash flow during the construction period. Therefore, the private sector is unlikely to fund the total capital expenditure through equity participation.

Sources of Finance

Innovative Means of finance

Mezzanine Means

These include subordinate debt and preference shares that fall in between senior debt and equity. Payment is made to these investors only after senior debt is serviced and upon complying with certain conditions such as adherence to coverage ratios and investment requisites related to project performance. The risks taken by mezzanine providers are lower than those of traditional equity investors. Since the use of mezzanine means of finance reduces the amount of equity required for the project, it works to the advantage of the project company.

Capital Markets – Bond Financing

Bonds are common means of financing in corporate finance whereas the same as a means of financing in project financing is not very common. The commercial debt financing in project finance are offered under a floating rate with a medium-term maturity whereas, bond financing offer long-term maturity by institutional investors thus making it a better option of debt financing.

Role of the Public Sector in Project Finance

The Government’s support to the private partner, in a PPP project, aimed at enabling the partner to arrange finance, works to a project’s advantage. Internationally, there are certain instruments that allow public participation in project finance and these instruments range from revenue enhancements to equity guarantees. However, these instruments need to be used with an element of caution.

a. Equity guarantees are a mechanism under which the public entity provides the concessionaire with an option to be bought out at a price that guarantees a minimum return on equity.

b. Under debt guarantees, the public entity pays for any shortfall related to principal and interest repayments by the private partner. The Government could also guarantee re-financing of the project.

Cost of Capital

Depending on the means used to finance a project, costs will differ since the cost of raising debt and equity are different. The effective cost of capital (or cost of raising funds) for a project is measured in terms of the Weighted Average Cost of Capital (WACC). WACC takes into consideration the amount and cost of debt and equity raised for the project.

The formula for WACC is

WACC = E x Re + D x Rd x (1-T)

Here,

E = Market value of the company‟s equity

D = Market value of the company‟s debt

Re = Cost of Equity

Rd = Cost of Debt or interest rate at which debt is raised

T= Tax Rate applicable for the project

Revenue Estimations

The revenues are based on the demand for the asset/service and the corresponding tariff rate. Estimation of revenues would be a fall out of the technical studies such as market study, traffic study, etc. that are carried out for the project.

Financial Feasibility Assessment

Financial analysis usually is conducted using a cash flow model. The model projecting cash flows may be simple or very complex depending on the type and size of the project and the variables involved. Capital expenditure, revenues, expenses, terminal cash flow (if any), discount rate and general assumptions are used to calculate cash flow projections, which is the key element in financial analysis.

Since the financial feasibility of a project is assessed on the basis of proposed investments in, and projected cash flows from, the project, it is only prudent to assess the present value of future investments and cash flows to understand the net financial costs and benefits to stakeholders. Annexure 6A of this module sets out an indicative structure of the Financial Feasibility report.

Optimise Financial Viability

The financial viability of a project could be optimised by analysing various options such as change of scope, type of PPP structure adopted, duration of the PPP arrangement, increased tariff, provision of Government support in terms of Viability Gap Funding or other grants, unbundling a project, Government guarantees for transferred risk, risk transfer to the Government, Government inputs in operations at subsidised rates etc.

Lenders’ Concerns on PPP Funding

Banks play a crucial role in PPP arrangements. In a PPP, the private partner is highly incentivised to deliver the project on time and within the budget. In case the private partner fails to complete the project on time, it will need to request the banks to allow delayed repayment of debt, as revenues would be delayed. In case of cost overruns, the private partner would need to ask the bank to increase the loan. In such cases, the banks may impose penalties on these companies leading to a lower return on investment for the shareholder.

The amount of debt which could be raised by a project company is primarily determined by its ability to service its debt services from future cash flows with reasonable comfort. The lenders generally estimate this ability based on a set of ratios that are calculated on a periodic basis over the life of a project.

Download Study Notes PDF

Register as member and login to download attachment use this only for Educational Purpose

FD Planning Community Forum Discussion

- State Finance Commissions and Rural Local Bodies Devolution of Resources

- Interview with B K Sinha – The Municipal midas

- Municipal bond in India

- Bilateral and Multi-lateral Financial Institutions

- Cost recovery

- Investment needs and Budgeting for Infrastructure and Service in Metro towns

- Subsidy Reduction

- Revenue Sources of Controlling Authorities

- Public Private partnership

Disclaimer

Information on this site is purely for education purpose. The materials used and displayed on the Sites, including text, photographs, graphics, illustrations and artwork, video, music and sound, and names, logos, IS Codes, are copyrighted items of respective owners. Front Desk is not responsible and liable for information shared above.

1 thought on “Financial Feasibility”