Social Cost Benefit Analysis (SCBA) is a tool used to assess the social, economic and environmental costs and benefits of a proposed project. The purpose of SCBA is to help decision-makers assess the true impact of a project on society as a whole, rather than just its impact on individual stakeholders or groups.

In SCBA, the costs and benefits of a project are measured in monetary terms, which allows decision-makers to compare them on an equal footing. The costs and benefits are estimated over the life of the project and discounted to reflect their present value.

The steps involved in SCBA include:

- Identifying and measuring the costs and benefits of the project: This involves identifying all of the costs and benefits associated with the project, including any externalities that may affect society as a whole.

- Assigning a monetary value to the costs and benefits: This involves estimating the monetary value of each cost and benefit, using market prices or other valuation techniques.

- Discounting the costs and benefits: This involves adjusting the estimated costs and benefits to reflect their present value, using a discount rate that reflects the time value of money.

- Aggregating the costs and benefits: This involves adding up the estimated costs and benefits over the life of the project, to arrive at a total cost and benefit figure.

- Conducting a sensitivity analysis: This involves testing the impact of changes in key assumptions or variables on the results of the analysis, to assess the robustness of the findings.

- Making a decision: Finally, decision-makers can use the results of the SCBA to make an informed decision about whether or not to proceed with the project.

SCBA can be a useful tool in decision-making for a wide range of projects, including public infrastructure, environmental projects, and social welfare programs. It allows decision-makers to compare the costs and benefits of a project in a comprehensive and systematic way, and to identify any potential externalities that may affect society as a whole.

A social appraisal of a project goes beyond an economic appraisal to determine

which projects will increase welfare once their distribution impact is considered. Social

appraisal therefore tackles the moral and theoretical dilemma-that a project is worth undertaking if it has the potential to produce a Pareto improvement in welfare.

Distributional Weights

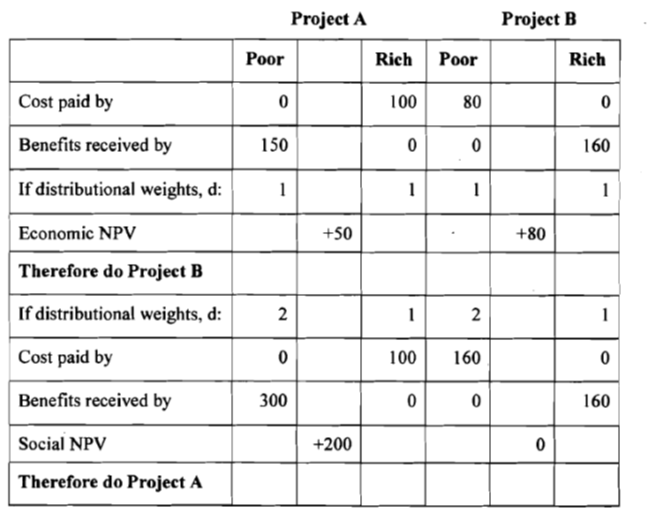

One of the most commonly used methods of undertaking a social cost benefit analysis is to introduce distributional weights in to the cash flow. Distributional weights are attached to changes in income, costs and benefits, received by different income groups, ensuring that a project’s impact on the income of low income groups receives a higher weight than the same rupees impact on the income of high income groups.

In the example shown below the government of a country with a highly skewed income distribution is considering two mutually exclusive projects, A and B. Project A’s costs are borne by the rich and its benefits are received by the poor, while project B is the opposite. Its costs are borne by the poor and its benefits are received by the wealthy. Since the two projects are mutually exclusive the project with the highest NPV should be selected

The Use of Distributional Weights in Social Analysis of Projects ( Million rupees)

Register & Download PDF for Educational Purposes Only

Project Planning and Management Study notes for M. plan Sem-II

project planning and management.pdf

Register as member and login to download attachment [pdf] by right-click the pdf link and Select “Save link as” use for Educational Purposes Only

Disclaimer

Information on this site is purely for education purpose. The materials used and displayed on the Sites, including text, photographs, graphics, illustrations and artwork, video, music and sound, and names, logos, IS Codes, are copyrighted items of respective owners. Front Desk is not responsible and liable for information shared above.