Reforms in municipal finance have been undertaken in India to improve the financial health and performance of urban local bodies. Some of the key reforms include:

- Property tax reforms: Property tax is a major source of revenue for urban local bodies. To improve the collection efficiency and equity of property tax, reforms such as property tax base revision, computerization of tax records, and introduction of geographic information system (GIS) have been implemented.

- User charges reforms: User charges are fees charged for the use of public services such as water, sanitation, and solid waste management. Reforms such as revision of user charges based on the cost of service delivery and introduction of metering and volumetric pricing have been implemented to enhance the cost recovery and sustainability of public services.

- Grant reforms: Grants from the central and state governments are an important source of funding for urban local bodies. Reforms such as introduction of performance-based grants, untied grants, and direct transfers to urban local bodies have been implemented to enhance the fiscal autonomy and accountability of urban local bodies.

- Debt management reforms: Urban local bodies often rely on borrowings to fund their capital investments. Reforms such as introduction of credit rating for urban local bodies, issuance of municipal bonds, and development of pooled financing mechanisms have been implemented to enhance the creditworthiness and access to affordable credit for urban local bodies.

- Financial management reforms: Financial management reforms such as implementation of accrual-based accounting, budgeting, and financial reporting have been undertaken to enhance the transparency, accountability, and efficiency of financial management practices of urban local bodies.

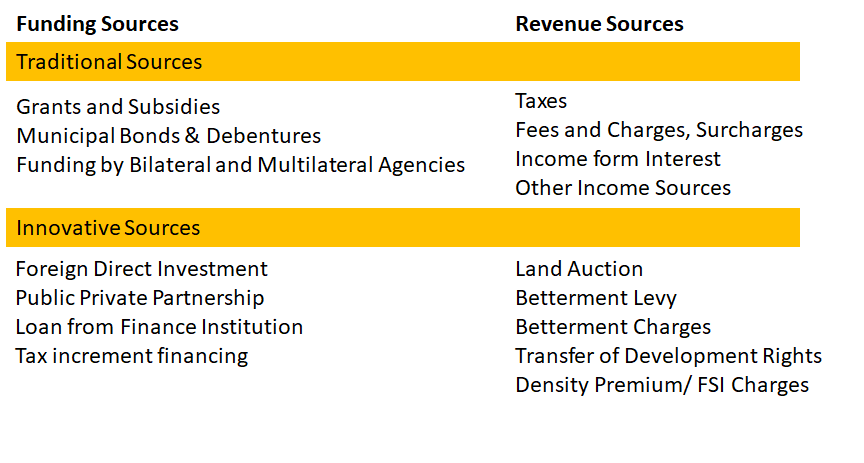

The 74th Constitutional Amendment Act of 1992, recognized the importance of local self governments in the process of service delivery in the urban sector. In August, 1996, UDPFI guidelines suggest innovative approaches for fiscal resource mobilization.

In the backdrop of the New Economic Policy in the 1990, it was suggested that the traditional system of funding based on Plan and budgetary allocations be reduced and ultimately withdrawn due to fiscal deficit. Subsidies need to be rationalised and urban development plans and projects need to be placed on a commercial format by designing commercially viable urban infrastructure services and area development projects. This was sought to be achieved by restoring a proper match between functions and source of revenue by giving additional tax measures.

The Thirteenth Finance Commission has brought in an element of performance based grant in addition to basic grant, in which the onus is placed on the State Governments to empower and build capacity in the local bodies through carrying out nine identified reforms.

These reforms have contributed to improving the financial health and performance of urban local bodies in India. However, sustained efforts are required to strengthen the institutional framework and governance mechanisms for effective implementation of these reforms.

Download Study Notes PDF

Register as member and login to download attachment use this only for Educational Purpose

FD Planning Community Forum Discussion

- State Finance Commissions and Rural Local Bodies Devolution of Resources

- Interview with B K Sinha – The Municipal midas

- Municipal bond in India

- Bilateral and Multi-lateral Financial Institutions

- Cost recovery

- Investment needs and Budgeting for Infrastructure and Service in Metro towns

- Subsidy Reduction

- Revenue Sources of Controlling Authorities

- Public Private partnership

Disclaimer

Information on this site is purely for education purpose. The materials used and displayed on the Sites, including text, photographs, graphics, illustrations and artwork, video, music and sound, and names, logos, IS Codes, are copyrighted items of respective owners. Front Desk is not responsible and liable for information shared above.

1 thought on “Reforms in Municipal Finance”