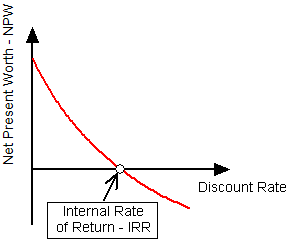

An internal rate of return is the discounting rate, which brings discounted future cash flow at par with the initial investment. In other words, it is the discounting rate at which the company will neither make loss nor make a profit.

The Internal Rate of Return (IRR) is a financial metric used to calculate the rate at which an investment breaks even, or in other words, the rate at which the net present value (NPV) of an investment becomes zero. The IRR is essentially the discount rate at which the sum of all future cash flows from an investment is equal to the initial investment amount.

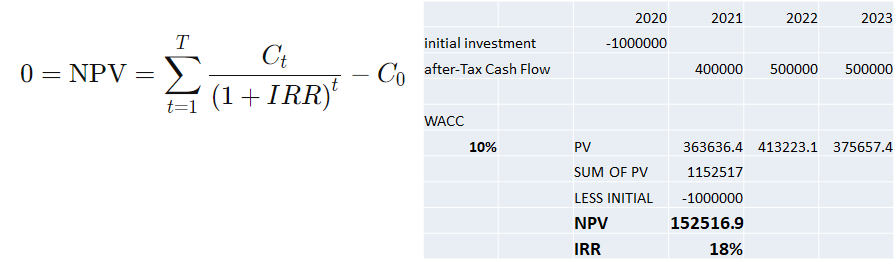

To calculate the IRR, you need to know the initial investment amount, as well as the expected cash flows from the investment over its life. These cash flows can be positive or negative and should be discounted to their present values using a discount rate. The IRR is the discount rate that makes the net present value of these cash flows equal to zero.

The IRR is often used in financial analysis to compare the profitability of different investments. Generally, a higher IRR is better, as it indicates a higher rate of return on the investment. However, it is important to note that IRR has some limitations, including assumptions about the reinvestment of cash flows and the timing of those cash flows. Therefore, it should be used in conjunction with other financial metrics to make informed investment decisions.

It is obtained by trial & error method. We can also state that IRR is the rate at which the NPV of the project will be zero. i.e. Present value of cash inflow – Present value of cash outflow = zero

where:

Ct=Net cash inflow during the period t

C0=Total initial investment costs

IRR=The internal rate of return

t=The number of time periods

Register & Download PDF for Educational Purposes Only

Project Planning and Management Study notes for M. plan Sem-II

project planning and management.pdf (Size: 1.29 MB / Downloads: 29)

Register as member and login to download attachment [pdf] by right-click the pdf link and Select “Save link as” use for Educational Purposes Only

FD Planning Community Forum Discussion

- What different types of Projects can be taken up for Urban Development?

- Project Appraisal of city level projects

- Demand Forecasting methods for Project

- Location analysis for a project

- Role and Responsibilities of Govt. Organizations in project management

- Principles of activity planning

- Defining Activities of activity planning

- Sequencing Activities of Activity planning

- Estimating Activity Resources of Activity planning

- Develop Schedule of Activity planning

Disclaimer

Information on this site is purely for education purpose. The materials used and displayed on the Sites, including text, photographs, graphics, illustrations and artwork, video, music and sound, and names, logos, IS Codes, are copyrighted items of respective owners. Front Desk is not responsible and liable for information shared above.