Net Present Value (NPV) is a financial appraisal technique that is commonly used in investment and project analysis to evaluate the financial profitability of an investment or project. It calculates the present value of the future cash inflows generated by the investment or project, less the present value of the future cash outflows required to fund the investment or project. The difference between the present value of the cash inflows and the present value of the cash outflows is the net present value.

The basic idea behind the NPV technique is that money has a time value, meaning that a dollar received in the future is worth less than a dollar received today. This is because money can be invested today to earn interest, so the future value of that dollar is greater than the present value of that dollar. The NPV technique takes this into account by discounting future cash flows back to their present value using a discount rate that reflects the opportunity cost of investing in the investment or project.

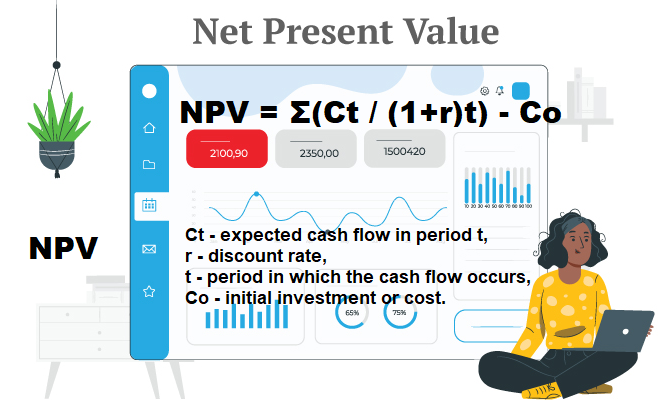

The formula for calculating the NPV of an investment or project is:

NPV = Σ(Ct / (1+r)t) – Co

where:

- Σ means “the sum of”,

- Ct is the expected cash flow in period t,

- r is the discount rate,

- t is the period in which the cash flow occurs, and

- Co is the initial investment or cost.

If the NPV is positive, it means that the investment or project is expected to generate a profit, and therefore, it is considered financially viable. If the NPV is negative, it means that the investment or project is expected to generate a loss, and therefore, it is considered financially unviable.

Overall, the NPV technique is a valuable tool for evaluating investment or project opportunities and making informed decisions based on their potential financial viability.

Assumptions in calculating the net present value

The following assumptions are made about cash flows when calculating the net present value: NPV ={T0 + T1 + …….. } – Initial Investment •all cash flows occur at the start or end of a year •initial investments occur T0 •other cash flows start one year after that (T1) •Also interest payments are never included within an NPV calculation as these are taken account of by the cost of capital. •Net present value is the sum of discounted future cash inflow & outflow related to the project. Generally, the weighted average cost of capital (WACC) is the discounting factor for future cash-flows in net present value method.

The stream of benefit from project is discounted to its present value from which initial cost is subtracted to get the net present value of project

NPV = B1/ (1+r) +B2/(1+r)2 +B3/(1+r)3 +B4/(1+r)4+Bn/(1+r)n –initial investment

B1,B2, B3 …..Bn . Net benefit each year up to the last year counted

Example :

XYZ Inc. is starting the project at cost of Rs. 10,00,000. The project will generate cash-flow of Rs. 4,00,000 , Rs. 5,00,000 & Rs. 5,00,000 in year 1, year 2 & year 3 respectively. Company’s WACC is 10%. Find out NPV.

Formula of NPV = [4,00,000/( 1+0.1)1] + [ 5,00,000 / (1+0.1)2 ] +[ 5,00,000/ (1+0.1)3 ] – 10,00,000

Net present value = 3,63,636.3 + 4,13,223.1 +3,75,657.4 – 10,00,000

= 11,52,516.8 – 10,00,000

The net present value of the project is 1,52,516.8

Here, the net present value of the project is positive & therefore the project should be accepted.

Register & Download PDF for Educational Purposes Only

Project Planning and Management Study notes for M. plan Sem-II

project planning and management.pdf (Size: 1.29 MB / Downloads: 29)

Register as member and login to download attachment [pdf] by right-click the pdf link and Select “Save link as” use for Educational Purposes Only

Disclaimer

Information on this site is purely for education purpose. The materials used and displayed on the Sites, including text, photographs, graphics, illustrations and artwork, video, music and sound, and names, logos, IS Codes, are copyrighted items of respective owners. Front Desk is not responsible and liable for information shared above.